Why Select a Regional Mortgage Broker Glendale CA for Personalized Service

Why Select a Regional Mortgage Broker Glendale CA for Personalized Service

Blog Article

Discovering Why Partnering With a Home Loan Broker Can Significantly Streamline Your Home Purchasing Experience

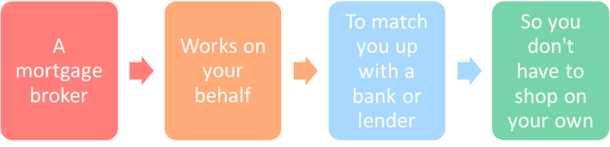

Browsing the complexities of the home purchasing procedure can be overwhelming, yet partnering with a mortgage broker provides a calculated benefit that can simplify this experience. By acting as middlemans in between you and a wide range of loan providers, brokers supply accessibility to customized finance alternatives and experienced understandings that can mitigate potential obstacles.

Understanding Mortgage Brokers

These professionals have extensive expertise of the mortgage market and its guidelines, allowing them to browse the intricacies of the lending process effectively. They aid consumers in gathering required paperwork, completing finance applications, and ensuring that all needs are met for a smooth approval process. By working out terms in support of the borrower, home mortgage brokers usually work to safeguard desirable rate of interest and conditions.

Ultimately, the competence and resources of mortgage brokers can significantly improve the home getting experience, relieving several of the burdens typically associated with securing financing. Their role is crucial in helping borrowers make informed choices customized to their financial goals and unique conditions.

Advantages of Utilizing a Broker

Using a mortgage broker can offer numerous benefits for property buyers and those wanting to refinance. One substantial advantage is access to a broader array of financing alternatives. Unlike banks that may just provide their own items, brokers collaborate with multiple lending institutions, allowing clients to discover different mortgage remedies customized to their particular economic circumstances.

Additionally, mortgage brokers possess comprehensive market understanding and know-how. They remain educated regarding market patterns, passion prices, and loan provider demands, ensuring their clients receive prompt and exact details. This can cause extra positive finance terms and possibly lower rate of interest rates.

Furthermore, brokers can help recognize and resolve prospective challenges early in the mortgage process. Their experience permits them to anticipate difficulties that may arise, such as credit scores issues or documents demands, which can save clients time and stress and anxiety.

Finally, dealing with a home mortgage broker usually causes customized service. Brokers generally invest time in recognizing their customers' unique demands, leading to an extra tailored strategy to the home-buying experience. This mix of accessibility, know-how, and customized service makes partnering with a home loan broker an important property for any type of buyer or refinancer.

Streamlined Application Process

The procedure of making an application for a home mortgage can typically be frustrating, however partnering with a broker dramatically simplifies it (Mortgage Broker Glendale CA). A home mortgage broker serves as an intermediary in between the lender and the debtor, streamlining the application process via expert support and company. They begin by examining your economic situation, gathering essential files, and comprehending your details needs, making sure that the application is customized to your circumstances

Brokers are well-versed in the intricacies of mortgage applications, assisting you stay clear of usual mistakes. They supply quality on called for documentation, such as income verification, credit reports, and asset statements, making it much easier for you to collect and send these products. With their extensive experience, brokers can anticipate potential challenges and address them proactively, discover this info here decreasing delays and irritations.

Access to Several Lenders

Accessibility to a diverse selection of loan providers is just one of the essential benefits of partnering with a mortgage broker. Unlike conventional home acquiring methods, where purchasers are often limited to a couple of lenders, home loan brokers have actually established connections with a vast array of banks. This comprehensive network permits brokers to present clients with several loan choices customized to their financial scenarios and unique needs.

By having access to different loan providers, brokers can promptly identify competitive interest rates and positive terms that might not be readily available via straight networks. This not only enhances the potential for securing a more additional info beneficial home loan however likewise expands the range of offered items, including specific finances for new customers, experts, or those looking for to spend in buildings.

In addition, this accessibility conserves time and initiative for property buyers. Rather than getting in touch with several lenders individually, a mortgage broker can simplify the procedure by gathering required documentation and sending applications to numerous loan providers concurrently. This effectiveness can lead to quicker authorization times and a smoother total experience, enabling buyers to concentrate on discovering their optimal home instead of browsing the intricacies of mortgage alternatives alone.

Individualized Assistance and Support

Browsing the home loan landscape can be frustrating, however partnering with a mortgage broker gives individualized assistance and assistance customized to each client's certain needs. Mortgage brokers act as middlemans, recognizing specific financial scenarios, preferences, and lasting goals. This personalized technique guarantees that customers receive suggestions and services that straighten with their distinct conditions.

A proficient mortgage broker carries out comprehensive analyses to identify the very best funding options, taking into consideration factors such as credit history, earnings, and debt-to-income proportions. They also inform customers on various mortgage items, aiding them comprehend the implications of various passion rates, terms, and fees. This understanding equips customers to make enlightened choices.

Furthermore, a home loan broker supplies continuous assistance throughout the whole home acquiring procedure. From pre-approval to closing, they facilitate communication between clients and loan providers, resolving any concerns that may occur. This constant support minimizes anxiety and conserves time, allowing clients to concentrate on locating their desire home.

Verdict

Finally, partnering with a mortgage broker offers numerous benefits that can significantly enhance the home buying experience. By providing access to a vast selection of loan alternatives, promoting a structured application procedure, and using professional assistance, brokers efficiently mitigate obstacles and lower anxiety for property buyers. This professional support not just enhances efficiency but additionally boosts the possibility of securing desirable finance terms, eventually adding to an extra satisfying and effective home purchasing trip.

Navigating the intricacies of the home getting process can be daunting, yet partnering with a home mortgage broker provides a strategic benefit that can streamline this experience.Home mortgage brokers serve as middlemans between lenders and debtors, facilitating the financing process for Click This Link those looking for to purchase a home or re-finance an existing home loan. By streamlining the application, a home loan broker enhances your home getting experience, permitting you to focus on locating your dream home.

Unlike conventional home acquiring methods, where purchasers are often limited to one or 2 lenders, home loan brokers have actually developed relationships with a large array of financial organizations - Mortgage Broker Glendale CA.Browsing the mortgage landscape can be overwhelming, however partnering with a home mortgage broker offers individualized advice and support tailored to each customer's details needs

Report this page